Types of Investment Funds in the UK

The UK offers a diverse range of investment funds, each catering to different investor profiles and risk appetites. Understanding the various types available is crucial for making informed investment decisions. This section will explore the key categories of UK investment funds, highlighting their characteristics and associated risks.

Unit Trusts and OEICs

Unit trusts and Open-Ended Investment Companies (OEICs) are both types of collective investment schemes that pool money from multiple investors to invest in a diversified portfolio of assets. Unit trusts are trusts where investors own units representing a share of the underlying assets. OEICs, on the other hand, are companies whose shares are traded on the stock exchange. Both offer daily dealing, meaning investors can buy and sell units or shares relatively easily. However, OEICs generally offer greater flexibility in terms of management structure and investment strategy. The primary difference lies in their legal structure and how they are managed. Unit trusts have a trustee responsible for overseeing the fund’s management, while OEICs have a board of directors.

Investment Trusts

Investment trusts are also collective investment schemes, but unlike unit trusts and OEICs, they are listed companies that raise capital through the issuance of shares. These shares are traded on the stock exchange, meaning their price can fluctuate independently of the net asset value (NAV) of the underlying assets. Investment trusts often offer a geared investment strategy, using borrowed money to amplify returns (and losses). This gearing can lead to higher potential returns but also significantly increased risk. They also typically have a longer-term investment horizon compared to unit trusts and OEICs.

Actively Managed vs. Passively Managed Funds

Investment funds can be broadly classified as either actively managed or passively managed. Actively managed funds employ fund managers who actively select investments aiming to outperform a benchmark index. This approach involves significant research and trading costs, and success is not guaranteed. Passively managed funds, also known as index funds or tracker funds, aim to replicate the performance of a specific market index, such as the FTSE 100. They generally have lower fees than actively managed funds, as they require less active management. The risk profile of actively managed funds can vary significantly depending on the investment strategy, while passively managed funds’ risk is largely determined by the underlying index they track.

Risk Profiles of Different Fund Types

The risk associated with each fund type varies considerably. Unit trusts and OEICs generally carry moderate to high risk depending on the underlying investments. Investment trusts, due to the potential use of gearing, can be considered higher risk. Passively managed funds tracking a broad market index tend to have lower risk than actively managed funds, though market downturns will still impact their value. The specific risk profile will also depend on the asset class the fund invests in (e.g., equities, bonds, property). Investing in higher-risk assets such as emerging market equities will naturally carry a higher risk than investing in lower-risk assets like government bonds.

Comparison of Key Features

| Fund Type | Structure | Trading | Risk Profile |

|---|---|---|---|

| Unit Trust | Trust | Daily | Moderate to High (depending on underlying assets) |

| OEIC | Company | Daily | Moderate to High (depending on underlying assets) |

| Investment Trust | Listed Company | Exchange Traded | High (potential for gearing) |

| Passive (Index) Fund | Various | Daily | Lower (relative to actively managed funds) |

Factors Influencing Investment Fund Performance

The performance of UK investment funds is a complex interplay of various factors, both internal and external. Understanding these influences is crucial for investors seeking to make informed decisions and manage their risk effectively. While past performance is not indicative of future results, analyzing these factors can provide valuable insights into potential future trends.

Macroeconomic Factors and UK Fund Performance

Macroeconomic conditions significantly impact investment fund returns. Interest rate changes, for example, directly affect fixed-income funds. A rise in interest rates typically leads to lower bond prices, impacting the value of these funds, while a decrease can boost their performance. Inflation, another key factor, erodes purchasing power. Funds invested in assets that can outpace inflation, such as equities or inflation-linked bonds, may offer better protection during inflationary periods. Unexpected economic downturns or periods of high volatility, such as those experienced during the 2008 financial crisis or the COVID-19 pandemic, can severely impact the performance of various asset classes across the UK investment landscape. For instance, during the 2008 crisis, many equity funds experienced significant losses, while some more defensive funds held up relatively better.

Key Market Indicators for Evaluating UK Investment Funds

Several market indicators provide valuable insights into the health of the UK economy and the potential performance of investment funds. The FTSE 100 index, a benchmark for large-cap UK equities, reflects the overall performance of the UK stock market. Changes in this index can signal broader market trends. Other key indicators include GDP growth, which indicates the overall economic health, and unemployment rates, which reflect consumer spending and confidence. Inflation data, as mentioned previously, is critical in assessing the real return of investments, after adjusting for the erosion of purchasing power. Monitoring these indicators allows investors to gauge the potential impact on their chosen funds.

Fund Manager Expertise and Investment Outcomes

The expertise and experience of the fund manager play a significant role in investment outcomes. A skilled manager can navigate market volatility, identify undervalued assets, and implement effective investment strategies to enhance returns. Their ability to conduct thorough research, analyze market trends, and make timely decisions directly influences fund performance. Different fund managers employ different investment philosophies, such as value investing, growth investing, or a blend of both. The manager’s track record, investment approach, and risk management strategies should all be considered when evaluating a fund. For example, a value-focused manager may outperform during periods of market correction, while a growth-focused manager may excel during periods of rapid economic expansion.

The Role of Fees and Expenses in Impacting Fund Returns

Fees and expenses, including management fees, administration charges, and transaction costs, directly reduce a fund’s overall returns. These costs can significantly eat into profits over the long term, especially for funds with high expense ratios. Investors should carefully compare the expense ratios of different funds before investing to ensure they are receiving competitive returns. A fund with a higher expense ratio may need to outperform a lower-cost fund by a considerable margin to provide equivalent returns to the investor. Understanding the fee structure is crucial for making informed investment choices. For example, a fund with a 1% annual expense ratio will reduce an investor’s return by 1% annually, compounding over time.

Assessing Fund Risk and Return: Best Investment Funds UK

Understanding the risk and return profile of UK investment funds is crucial for making informed investment decisions. This involves not only assessing the potential for profit but also quantifying the potential for loss. A balanced approach considers both aspects to determine the suitability of a fund for a particular investor’s risk tolerance and financial goals.

Sharpe Ratio Calculation and Other Risk-Adjusted Performance Metrics

The Sharpe ratio is a widely used metric to evaluate the risk-adjusted return of an investment. It measures the excess return (return above the risk-free rate) per unit of risk (standard deviation). A higher Sharpe ratio indicates better risk-adjusted performance. Other risk-adjusted metrics include the Sortino ratio (which only considers downside deviation) and the Treynor ratio (which uses beta as a measure of risk). These metrics provide a more nuanced understanding of a fund’s performance than simply looking at its return alone. The calculation for the Sharpe ratio is as follows:

Sharpe Ratio = (Rp – Rf) / σp

Where: Rp = Portfolio return, Rf = Risk-free rate of return, σp = Standard deviation of portfolio return

For example, if a fund has an average annual return of 12%, a risk-free rate of 2%, and a standard deviation of 8%, its Sharpe ratio would be (0.12 – 0.02) / 0.08 = 1.25. This suggests a relatively good risk-adjusted return. It’s important to compare Sharpe ratios across different funds to make meaningful comparisons. Access to historical fund data, often available through financial data providers like Refinitiv or Bloomberg, is necessary for accurate calculation.

Hypothetical Portfolio of UK Investment Funds with Varying Risk Levels and Return Expectations

Let’s consider a hypothetical portfolio comprising three UK investment funds with different risk profiles:

| Fund | Asset Class | Expected Return | Risk Level (Standard Deviation) |

|---|---|---|---|

| Fund A | UK Government Bonds | 3% | 2% |

| Fund B | UK Large-Cap Equities | 8% | 12% |

| Fund C | Emerging Market Equities | 15% | 20% |

Fund A represents a low-risk, low-return investment, while Fund C represents a high-risk, high-return investment. Fund B occupies a middle ground. The expected returns and risk levels are illustrative and will vary depending on market conditions. A well-diversified portfolio might allocate capital across these funds based on an investor’s risk tolerance. For example, a risk-averse investor might allocate a larger portion to Fund A, while a more aggressive investor might favour Fund C. Real-world examples include target-date funds, which automatically adjust the allocation to different asset classes based on the investor’s time horizon and risk profile.

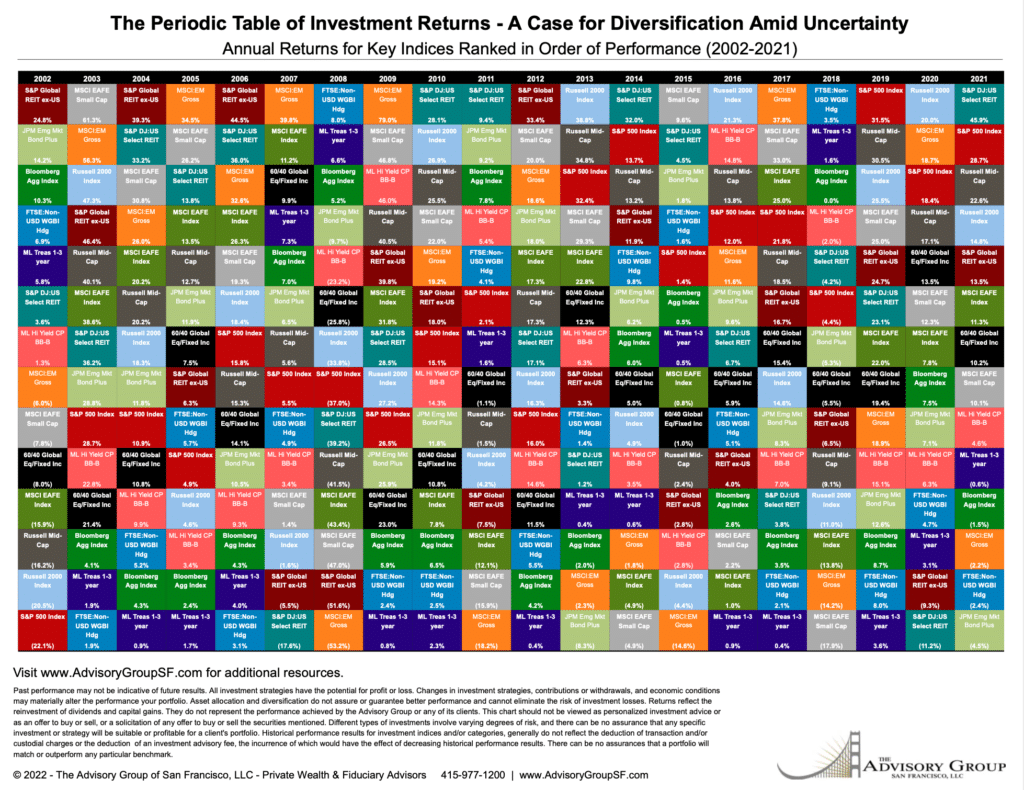

Importance of Diversification Within a UK Investment Fund Portfolio

Diversification is a cornerstone of successful investing. It involves spreading investments across different asset classes, sectors, and geographies to reduce the overall risk of the portfolio. By diversifying within a UK investment fund portfolio, investors can mitigate the impact of poor performance in any single asset class. For example, if the UK equity market underperforms, the losses might be offset by gains in other asset classes, such as bonds or international equities. This reduces the volatility of the portfolio and helps to protect against significant losses.

Resources for Evaluating the Risk Profiles of Different UK Investment Funds

Several resources are available to help investors evaluate the risk profiles of UK investment funds. These include:

- Fund Fact Sheets and Key Investor Information Documents (KIIDs): These documents provide essential information about a fund’s investment strategy, risk profile, and past performance. They are usually available on the fund manager’s website.

- Financial News Websites and Publications: Reputable financial news sources often provide independent analysis and ratings of investment funds, including assessments of their risk levels. Examples include the Financial Times, The Economist, and Bloomberg.

- Financial Data Providers: Companies like Refinitiv and Bloomberg offer comprehensive data on investment funds, including historical performance data, risk metrics, and portfolio holdings, allowing for in-depth analysis.

- Independent Financial Advisers: Financial advisers can provide personalized guidance on selecting suitable investment funds based on an investor’s individual circumstances and risk tolerance.

Regulatory Environment for UK Investment Funds

The UK’s investment fund industry operates within a robust regulatory framework designed to protect investors and maintain market integrity. This framework is primarily overseen by the Financial Conduct Authority (FCA), ensuring transparency, fairness, and accountability within the sector. Understanding this regulatory landscape is crucial for both fund managers and investors.

The Financial Conduct Authority (FCA) plays a central role in regulating UK investment funds. Its responsibilities encompass overseeing the authorisation and ongoing supervision of fund managers, ensuring compliance with relevant legislation, and protecting investors from misconduct or market abuse. The FCA’s powers include the ability to investigate potential breaches of regulations, impose sanctions on non-compliant firms, and take enforcement action where necessary. This oversight is critical in maintaining public trust and confidence in the UK’s investment fund market.

The FCA’s Role in Regulating UK Investment Funds

The FCA’s regulatory remit extends across various aspects of the investment fund lifecycle. This includes the authorisation of fund managers, the approval of fund prospectuses, ongoing monitoring of fund activities, and enforcement action against those who fail to comply with the rules. The FCA sets standards for the conduct of business, aiming to ensure that investors receive clear and accurate information, are treated fairly, and their investments are managed competently. Furthermore, the FCA actively monitors market trends and adapts its regulatory approach to address emerging risks and vulnerabilities within the investment fund sector. This proactive approach helps to maintain the stability and integrity of the market.

Key Regulations Impacting Investors in UK Investment Funds

Several key regulations significantly impact investors in UK investment funds. The most prominent include the Financial Services and Markets Act 2000 (FSMA), which provides the overarching legal framework for financial services regulation in the UK, and the Prospectus Regulation, which mandates the disclosure of key information to potential investors before they commit their funds. Additionally, regulations concerning marketing communications, client asset protection, and the prevention of market abuse are all critical in safeguarding investor interests. Compliance with these regulations is essential for fund managers to operate legally and ethically. Failure to comply can lead to significant penalties, including fines and even criminal prosecution.

Investor Protection Mechanisms in Place for UK Investment Funds

The UK regulatory system incorporates several mechanisms designed to protect investors in UK investment funds. These include the requirement for fund managers to hold professional indemnity insurance, which provides compensation to investors in the event of professional negligence. Furthermore, regulations concerning the segregation of client assets ensure that investor funds are kept separate from the fund manager’s own assets, mitigating the risk of loss in the event of the fund manager’s insolvency. The Financial Services Compensation Scheme (FSCS) also provides a safety net for investors in the unlikely event of a fund manager’s failure, offering compensation up to a specified limit. This multi-layered approach significantly enhances investor protection.

Reporting Requirements for UK Investment Funds

UK investment funds are subject to stringent reporting requirements designed to ensure transparency and accountability. Fund managers are required to submit regular reports to the FCA, detailing the fund’s performance, holdings, and any significant events. These reports are subject to independent audit to ensure accuracy and completeness. Additionally, fund managers are required to provide regular updates to investors, outlining the fund’s performance and investment strategy. These reporting requirements provide investors with the information necessary to make informed decisions about their investments and to monitor the performance of their fund managers. The frequency and detail of these reports vary depending on the type of investment fund.

Accessing and Investing in UK Investment Funds

Investing in UK investment funds offers a diverse range of opportunities for building wealth, but understanding the different access points and associated costs is crucial for making informed decisions. This section details the various platforms available, compares their fees, Artikels the account opening process, and provides a structured approach to fund selection based on personal financial objectives.

Investment Platforms for UK Investment Funds

Several platforms facilitate investment in UK investment funds, each offering varying levels of service and cost. Choosing the right platform depends on your investment experience, financial goals, and desired level of support.

- Online Brokers: These platforms provide a cost-effective way to access a wide range of investment funds. They typically offer user-friendly interfaces, research tools, and often competitive fees. Examples include Hargreaves Lansdown, AJ Bell, and Interactive Investor. The ease of use and lower fees are attractive to self-directed investors.

- Financial Advisors: Financial advisors provide personalized advice and portfolio management services. They can help investors select suitable funds based on their risk tolerance, financial goals, and time horizon. While offering valuable expertise, this service usually comes with higher fees compared to online brokers. The personalized service is particularly beneficial for those new to investing or with complex financial situations.

- Banks and Building Societies: Some banks and building societies offer investment services, including access to investment funds. The range of funds available may be more limited than with dedicated investment platforms, and fees can vary significantly. This option provides convenience for existing customers but may lack the breadth of choice offered by specialist providers.

Costs and Fees Associated with Investment Platforms

The costs associated with investing through different platforms can significantly impact overall returns. It’s essential to compare fees carefully before choosing a platform.

- Platform Fees: These are annual charges levied by the platform for managing your account. They can be a percentage of your assets under management (AUM) or a fixed annual fee. These fees can vary widely, ranging from a few pounds per year to several hundred pounds, depending on the platform and the size of your investment portfolio.

- Fund Management Fees: These are separate fees charged by the fund managers themselves. They are expressed as a percentage of the fund’s assets and are deducted from the fund’s performance. These fees vary between funds and are disclosed in the fund’s prospectus.

- Transaction Fees: Some platforms charge fees for buying and selling funds. These fees can be a fixed amount per transaction or a percentage of the transaction value. Consider the frequency of your trading activity when assessing these costs.

Opening an Investment Account and Purchasing UK Investment Funds

The process of opening an investment account and purchasing UK investment funds generally involves these steps:

- Choose a Platform: Select an investment platform based on your needs and preferences, considering factors like fees, range of funds, and level of support.

- Complete an Application: You will need to provide personal information, including your address, National Insurance number, and financial details. The platform will typically conduct identity verification checks.

- Fund Your Account: Transfer funds into your investment account via bank transfer, debit card, or other methods offered by the platform.

- Select Funds: Research and select the funds you wish to invest in, considering your risk tolerance, investment goals, and the fund’s performance history.

- Place an Order: Submit your investment order through the platform. You will specify the amount you wish to invest in each fund.

- Confirm and Monitor: Review your order confirmation and regularly monitor your investment performance.

Selecting Appropriate UK Investment Funds Based on Individual Financial Goals

A systematic approach is essential to select funds aligned with your financial goals.

- Define Financial Goals: Clearly articulate your objectives, such as retirement planning, purchasing a property, or funding your children’s education. Having specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial.

- Determine Your Risk Tolerance: Assess your comfort level with potential investment losses. Consider your time horizon – longer time horizons generally allow for greater risk-taking.

- Research and Compare Funds: Investigate various funds, comparing their performance history, expense ratios, investment strategies, and risk profiles. Utilise the Key Investor Information Documents (KIIDs) provided by fund managers.

- Diversify Your Portfolio: Spread your investments across different asset classes and fund types to reduce overall risk. Consider investing in a mix of equities, bonds, and potentially alternative investments.

- Regularly Review and Rebalance: Periodically review your portfolio’s performance and rebalance it to maintain your desired asset allocation. Market fluctuations can alter your portfolio’s balance over time.

Tax Implications of UK Investment Funds

Investing in UK investment funds can have significant tax implications, varying considerably depending on the type of fund, your individual circumstances, and the specific tax year. Understanding these implications is crucial for making informed investment decisions and maximising your returns after tax. This section will Artikel the key tax considerations for investors in UK investment funds.

Capital Gains Tax on UK Investment Funds

Capital Gains Tax (CGT) applies when you sell your investment fund units for a profit. The profit, known as a capital gain, is calculated by subtracting your purchase price (including any initial charges) from the sale price. The applicable CGT rate depends on your total income and the gain itself. Higher-rate taxpayers will face a higher CGT rate than basic-rate taxpayers. For example, a higher-rate taxpayer might pay 20% CGT on gains from investments held for longer than one year, while a basic-rate taxpayer might pay 10%. Gains from investments held for less than one year are generally taxed at a higher rate. It’s important to note that the specific rates are subject to change and should be verified with the latest HMRC guidelines. Careful consideration of the timing of disposals can help manage your CGT liability.

Income Tax on UK Investment Funds

Many investment funds generate income through dividends and interest payments from the underlying assets. This income is typically distributed to investors and is subject to Income Tax. The rate of Income Tax depends on your individual tax bracket. For example, income from dividends might be subject to dividend allowance before any tax is applied. Any income exceeding the allowance is taxed at your applicable income tax rate (basic, higher, or additional rate). Understanding the fund’s expected income distribution is crucial for budgeting and tax planning. For example, a high-yield bond fund will likely generate more income subject to tax compared to a fund investing primarily in growth stocks.

Tax Efficiency of Different Fund Structures

The tax efficiency of an investment fund can vary depending on its structure. For instance, Open-Ended Investment Companies (OEICs) and Investment Trusts are two common structures. OEICs are generally more straightforward in terms of tax, with income and gains being passed through to investors annually. Investment Trusts, on the other hand, benefit from a more tax-efficient structure as they can reinvest profits without immediately distributing them to investors, potentially reducing the overall tax burden over the long term. However, this comes with the potential drawback of less immediate income for investors. The specific tax implications of each structure are complex and require careful consideration.

Tax-Efficient Investment Strategies Using UK Funds

Employing tax-efficient investment strategies can significantly enhance your overall returns. One strategy is to utilise Individual Savings Accounts (ISAs) which offer tax-free growth and income on investments within the annual allowance limits. Investing in funds within an ISA can shield your investment gains from both CGT and Income Tax. Another strategy involves strategically timing the sale of fund units to minimise your CGT liability, taking into account your income level and overall tax position. Careful planning, potentially with professional financial advice, is key to optimising your tax efficiency. For instance, spreading disposals over multiple years could reduce the impact of CGT in any single tax year.

Ethical and Sustainable Investment Funds in the UK

The UK has witnessed a significant surge in the popularity of ethical and sustainable investment funds in recent years. Driven by increasing investor awareness of environmental, social, and governance (ESG) factors, and a growing demand for investments aligned with personal values, this sector has experienced substantial growth, attracting both individual and institutional investors. This reflects a broader global trend towards responsible investing, where financial returns are considered alongside positive societal and environmental impact.

Best investment funds UK – This growth is fueled by several factors, including increased regulatory scrutiny of ESG disclosures, the development of robust ESG rating methodologies, and the emergence of innovative financial products designed to meet the diverse needs of ethically conscious investors. Furthermore, the increasing availability of data and information on the ESG performance of companies has enabled investors to make more informed decisions.

ESG Rating Systems: A Comparison

Several organisations provide ESG ratings, each employing different methodologies and weighting schemes. This can lead to variations in the scores assigned to the same company. For example, MSCI and Sustainalytics are two prominent providers. MSCI’s ratings focus on a company’s exposure to ESG risks and opportunities, while Sustainalytics emphasizes the likelihood of a company facing material ESG-related controversies. Other rating agencies, such as FTSE Russell and Bloomberg, also offer their own ESG ratings, each with its unique approach and criteria. The lack of a universally accepted standard can make direct comparison challenging, highlighting the importance of understanding the methodology behind each rating system before making investment decisions.

Key Criteria for Evaluating Ethical and Social Impact

Evaluating the ethical and social impact of a UK investment fund requires a multi-faceted approach. Key criteria include the fund’s investment policy, which should clearly Artikel its ESG integration strategy and exclusion criteria. Transparency in reporting is crucial; investors should have access to detailed information on the fund’s ESG performance, including the methodology used to assess investments and the impact of those investments on key ESG metrics. Independent verification of ESG claims adds another layer of credibility. Furthermore, consideration should be given to the fund manager’s expertise and commitment to responsible investing. A strong track record and demonstrable commitment to ESG principles are vital.

Examples of UK Investment Funds with Strong ESG Profiles

Several UK investment funds demonstrate strong ESG profiles. While specific fund performance varies and past performance is not indicative of future results, examples could include funds focusing on renewable energy, sustainable agriculture, or companies with strong records on diversity and inclusion. It is important to note that the “strength” of an ESG profile is subjective and depends on the investor’s specific priorities and the chosen ESG rating system. Thorough due diligence, including reviewing the fund’s prospectus and fact sheet, is essential before making any investment decisions. Professional financial advice should be sought if needed.

Long-Term Investment Strategies with UK Funds

Investing in UK investment funds with a long-term perspective offers significant advantages, primarily due to the potential for compounding returns and the ability to ride out short-term market fluctuations. A well-structured long-term strategy allows investors to benefit from the growth potential of the UK economy and diverse asset classes while mitigating the risks associated with short-term market volatility. This approach requires patience, discipline, and a clear understanding of one’s risk tolerance.

Benefits of Long-Term Investing in UK Investment Funds

Long-term investment in UK funds allows investors to harness the power of compounding, where returns generated are reinvested, earning further returns over time. This exponential growth significantly boosts overall returns compared to shorter-term strategies. Furthermore, a long-term approach reduces the impact of short-term market corrections. While market downturns are inevitable, they are less impactful over extended periods, providing ample time for recovery. Finally, long-term investing facilitates a more strategic and less emotionally driven approach, preventing impulsive decisions based on short-term market noise.

Designing a Long-Term Investment Plan

A successful long-term investment plan should consider the investor’s time horizon and risk tolerance. For instance, an investor with a 20-year time horizon could allocate a larger portion of their portfolio to higher-growth, higher-risk assets like equities, while an investor with a 5-year time horizon might favour lower-risk, fixed-income investments. The plan should clearly define investment goals (e.g., retirement savings, children’s education), the desired asset allocation across different fund types (e.g., UK equity funds, global bond funds, property funds), and the regular investment schedule (e.g., monthly contributions). A diversified portfolio, incorporating a mix of asset classes and fund managers, is crucial to mitigate risk. For example, a balanced portfolio might include 60% UK equity funds, 30% global bond funds, and 10% alternative investments.

Regular Portfolio Reviews and Adjustments

Regular portfolio reviews are essential for ensuring the investment strategy remains aligned with the investor’s goals and risk tolerance. These reviews, ideally conducted annually or semi-annually, should assess the performance of individual funds, the overall portfolio allocation, and any changes in the investor’s circumstances (e.g., changes in income, risk tolerance, or time horizon). Based on the review, adjustments to the portfolio allocation may be necessary to rebalance the portfolio or to adjust to changing market conditions. For example, if a particular asset class has significantly outperformed others, rebalancing might involve selling some of the overperforming assets and reinvesting in underperforming ones to maintain the target allocation.

Strategies for Managing Risk and Maximizing Returns

Several strategies can be employed to manage risk and maximize returns in a long-term investment approach. Diversification across different asset classes and fund managers is paramount, reducing the impact of poor performance in any single investment. Regular rebalancing helps to maintain the desired risk profile and capitalize on market fluctuations. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, helps to reduce the impact of market timing and mitigate risk. Finally, choosing low-cost funds with a strong track record of performance can significantly enhance long-term returns. For example, index funds, which track a specific market index, offer diversification and low expense ratios, making them attractive for long-term investors.

Comparing UK Investment Funds to Global Alternatives

Investing in UK investment funds offers a convenient way to gain exposure to the domestic market, but limiting your portfolio solely to UK assets can present significant risks. A broader, globally diversified strategy often provides better risk-adjusted returns and greater resilience to economic fluctuations within the UK. This section compares the performance and characteristics of UK-focused funds against their global counterparts, highlighting the key considerations for investors.

The performance of UK investment funds has historically been variable, influenced by factors such as Brexit, global economic conditions, and the performance of specific UK sectors. Global funds, by contrast, offer diversification across multiple markets, potentially mitigating the impact of underperformance in any single region. While global funds may not always outperform UK-focused funds, their diversified nature typically leads to less volatile returns over the long term.

Benefits and Risks of Diversification, Best investment funds UK

Diversifying into global markets significantly reduces the risk associated with concentrating investments in a single country. A decline in the UK economy or a specific sector will have a proportionally smaller impact on a globally diversified portfolio compared to one focused solely on the UK. However, diversifying introduces its own complexities. Managing a global portfolio requires a greater understanding of international markets, currency fluctuations, and regulatory environments. The increased complexity may necessitate higher management fees. Further, global funds may underperform if the UK market significantly outpaces the rest of the world.

Key Factors for Comparing UK and International Investment Funds

Several key factors should be considered when choosing between UK-focused and globally diversified funds. These include:

- Investment Objectives: A fund’s investment objective (e.g., capital growth, income generation) significantly influences its composition and risk profile. Global funds often have a wider range of objectives compared to UK-focused funds.

- Risk Tolerance: Investors with a higher risk tolerance may prefer globally diversified funds that can offer higher growth potential, although with potentially greater volatility. Conversely, those with a lower risk tolerance might favor the perceived stability of a UK-focused fund, even if it means lower potential returns.

- Expense Ratio: The expense ratio reflects the fund’s management fees and other operating costs. Global funds may have higher expense ratios due to their broader scope and complexity.

- Past Performance: While past performance is not indicative of future results, examining a fund’s historical performance relative to its benchmark can provide valuable insights. This comparison should account for differing market conditions and investment strategies.

- Currency Risk: Investing in global funds exposes investors to currency fluctuations. Changes in exchange rates can impact the value of returns when converted back to the investor’s base currency.

Key Differences Between UK-Focused and Globally Diversified Funds

The following table summarizes the key differences:

| Feature | UK-Focused Fund | Globally Diversified Fund | Considerations |

|---|---|---|---|

| Geographic Focus | United Kingdom | Multiple countries and regions | Higher diversification reduces single-market risk but introduces currency risk. |

| Risk | Potentially higher, concentrated risk | Generally lower, diversified risk | Risk level depends on the specific fund’s investment strategy. |

| Return Potential | Potentially higher if the UK market outperforms | Potentially higher long-term, but may lag if the UK market significantly outperforms | Long-term performance often favors diversification. |

| Expense Ratio | Generally lower | Generally higher due to increased complexity | Higher expense ratios may erode returns over time. |

Understanding Fund Prospectuses and Key Information Documents

Fund prospectuses and Key Investor Information Documents (KIIDs) are crucial legal documents that provide prospective investors with comprehensive details about a UK investment fund. Carefully reviewing these documents is essential for making informed investment decisions and mitigating potential risks. Ignoring this step could lead to significant financial losses.

Understanding the information presented in these documents can be challenging due to their technical nature. However, taking the time to dissect the key elements is vital for aligning your investment choices with your financial goals and risk tolerance.

Key Information to Look For in Fund Prospectuses and KIIDs

These documents contain a wealth of information, but some key areas deserve particular attention. Understanding these elements allows investors to assess the suitability of a fund for their specific circumstances.

- Investment Objectives: The fund’s stated aims, such as capital growth, income generation, or a blend of both. A clear understanding of the investment objectives is crucial to ensure alignment with your personal financial goals.

- Investment Strategy: The methods used to achieve the fund’s objectives, including the types of assets held (e.g., equities, bonds, property), geographic focus, and investment style (e.g., value, growth).

- Risk Factors: A detailed explanation of the potential risks associated with the investment, including market risk, credit risk, and liquidity risk. This section should clearly Artikel the potential for loss and the factors that could impact the fund’s performance negatively.

- Fees and Expenses: A breakdown of all charges associated with the fund, including management fees, performance fees, and other expenses. These fees can significantly impact the fund’s overall return, so a thorough understanding is crucial.

- Past Performance: While past performance is not indicative of future results, it provides a historical context for the fund’s behaviour. However, it’s vital to remember that this is just one factor to consider and should not be the sole basis for investment decisions.

- Fund Manager Information: Details about the individuals or team responsible for managing the fund, including their experience and investment philosophy. Understanding the fund manager’s approach can provide insight into the fund’s likely performance characteristics.

Best Practices for Understanding Complex Financial Information

Navigating the complexities of fund documentation requires a structured approach. Breaking down the information into manageable chunks and seeking clarification when needed are essential steps.

- Read Slowly and Carefully: Avoid rushing through the document. Take your time to understand each section, and don’t hesitate to reread sections that are unclear.

- Use Multiple Resources: Supplement your reading of the prospectus with independent research from reputable financial sources. This can provide additional context and perspective.

- Seek Professional Advice: If you are unsure about any aspect of the fund’s documentation, seek advice from a qualified financial advisor. They can provide personalized guidance based on your financial situation and goals.

- Compare Funds: Don’t limit yourself to a single fund. Compare several funds with similar objectives to identify the best fit for your needs. This comparative analysis will help you identify the most suitable investment option based on your risk appetite and financial objectives.

Checklist of Questions Investors Should Ask Before Investing

Before committing to an investment, it’s vital to address any remaining uncertainties. This checklist facilitates a thorough assessment of the investment opportunity.

- Does the fund’s investment objective align with my financial goals?

- Can I comfortably tolerate the level of risk associated with this fund?

- Are the fees and expenses reasonable compared to similar funds?

- What is the fund manager’s track record and investment philosophy?

- What are the fund’s historical performance metrics and what factors influenced those results?

- What are the potential downsides and what are the contingency plans in place to mitigate those risks?

- What is the liquidity of the fund, and how easily can I access my investment if needed?

FAQ Corner

What is the minimum investment amount for UK investment funds?

Minimum investment amounts vary significantly depending on the specific fund and the platform used. Some funds may have relatively low minimums, while others may require substantial initial investments.

How often are UK investment fund returns distributed?

The frequency of income distributions (dividends) depends on the fund’s investment strategy. Some funds distribute income monthly, quarterly, or annually, while others reinvest the income back into the fund.

Are there any tax advantages to investing in UK investment funds within an ISA?

Yes, investing in UK investment funds within an ISA (Individual Savings Account) offers significant tax advantages. Gains within an ISA are generally tax-free.

What are the potential risks associated with investing in UK investment funds?

Potential risks include market fluctuations, fund manager performance, inflation, and currency risk (if investing in international funds). It’s crucial to understand the risk profile of any fund before investing.